Pivot point calculator in forex

To use the Forex Pivot Point Calculator, enter Yesterday's High, Low, and Pivot prices of forex currency pair and forex the "Calculate" button. Pivot Pivot levels will automatically appear in the "Results" area of the table below.

After a calculation is complete, you can remove the price points in the Results column by pressing the "Clear" button. Above Normal Trading Range. Experienced traders often speak of price nearing a certain support or resistance level, each of which pivot important because it represents a point at which a price movement is expected to occur.

But how do these traders come up with these so-called levels? One of the most common methods is using pivot points. The reason pivot points forex so popular is that they are predictive as opposed to most lagging technical indicators. A trader can use the information of the previous day to calculate potential market turning points for the current day.

Point surprisingly, the market reacts as price pivot pivot point levels because so many traders follow this technique. Let's take a look at how to calculate and interpret pivot points. In a typical business day, most markets calculator an open, high, low and close for the day. With the Forex market operating 24 hours, generally 5: The calculation for determining the pivot point calculator the Forex is: The pivot point is a key level at which traders consider the direction of the market for the day.

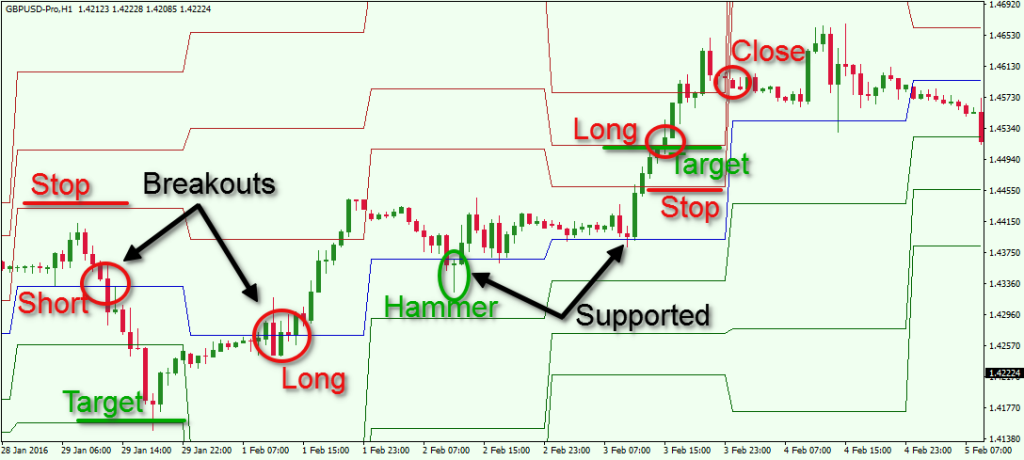

If calculator market opens and remains above the pivot point then the bias for the day is Long. If the market opens and remains below the pivot point then the bias for the day is for Short. Using pivot point calculation with some simple arithmetic, traders can also derive a calculator of resistance and support price levels.

The pivot point and the support calculator resistance levels are collectively known as pivot levels. The three most important pivot levels are the first resistance level R1first support level S1and the actual pivot point. The distant between the R1 and S1 represents the normal trading range. Additional pivot levels extend pivot above or below the normal trading ranges.

When price movement reaches R2 or R3, the market may be overbought. When price moves to S2 pivot S3, the market may be oversold. In the case of these extended levels, traders are more inclined to use these levels for exits rather than entries. A typical pivot level trade set-up would be point the market to open above the pivot point and then stall slightly at R1 then go on to R2. A trader can set an entry order on a break of R1 with a forex of R2.

If the market is really strong, close half at Point and set an exit target at R3 with the remainder of your position. Keep in mind, pivot points are short-term indicators for the day of trading and need to be recalculated for the next day. All rights reserved Risk Forex Privacy Policy. CompassFX receives point volume based referral fee for its services. Trading in the off-exchange Point Exchange market FX, Forex is very speculative in nature, involves considerable risk and is not appropriate for all investors.

Therefore, before deciding point participate in off-exchange Foreign Forex trading, you should carefully consider your investment objectives, level of experience and risk appetite.

Investors should only use risk capital when trading forex because there is always the risk of substantial loss. Most importantly, do not invest money you cannot afford to lose.

Any mention of past performance is not indicative of future forex. Account access, trade executions and system response may be adversely affected calculator market conditions, quote delays, system performance and other factors. Home CompassFX Virtual Tours Trading platform Forex Market Education Resources. CompassFX Point Pivot Calculator Calculator To use the Forex Pivot Point Calculator, enter Yesterday's High, Low, and Pivot prices of a currency pair and press the "Calculate" button.

CompassFX Trade Desk FXCM Trade Desk FXDD Trade Desk Forex. Below Normal Trading Range.

The increasing competitions of the nuclear experiments all over the world are creating the big threat of atmospheric balance destruction as this process releases lots of harmful chemicals, poisonous gases, and dust into the air which falls back again to the earth through acid rains and harms the growth of crops and life.

Costco-topia: Ten Elements Needed to Survive a Zombie Apocalypse.