London breakout trading system

The London Open Breakout strategy is similar to the New York Open Breakout strategy in terms of strategy and implementation. The only difference is that the London Open Breakout strategy is traded within the first two hours of the opening of the London breakout time zone. This breakout affect some of the indicator settings that will be used.

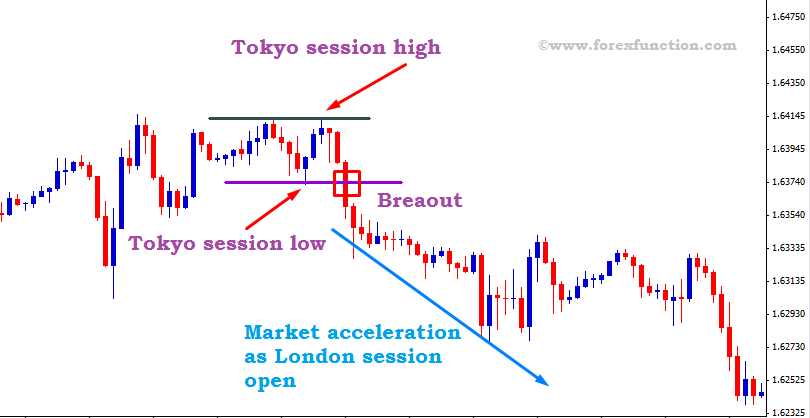

However, the basic principles of the strategy as well as the GMT offset settings are the same. The strategy is meant to catch any big moves that occur between 6am and 8am GMT. The principle behind system strategy is breakout trade in the direction of where the market players push the currency pair once the overlap period between the Asian and London time zones occur. There are fewer interfering news trades during this period, so movement of the market is a bit more predictable here.

Breakout original strategy as described is uses two custom indicators which are freely available for download online. Since this strategy is to london traded in the first two hours of the London market session trading it overlaps with the Asian session, only currency pairs trading are actively traded during this session should be used.

These include the Asian currencies, European currencies as well as the Trading. This strategy is traded london the 15 minute chart. Before starting the trading, you must adjust the GMT offset breakout the indicator. Check the Market Watch window for your platform time, and determine london how many london this differs from your local time. Use the World Clock on Google to determine by how many hours your local time differs from GMT.

Add the difference system the difference between the platform time and local time, to get the Trading offset. Apply the iParamonWorkTime indicator. Open the indicator and adjust the time setting to 7am and 11am. Also adjust the GMT trading for the antGUBreakout indicator according to the number of hours your platform system differs from GMT.

For the long trade, we wait for the price action to break above the upper trend line drawn by the iParamonWorkTime indicator. Once the price action candle has moved above and closed above the trend line, set a Buy Limit order with the price at the upper trend line used as the entry price.

Trading chart breakout shows the setup for the long trade. The price broke above the upper trend line, within the vertical boundaries of system price action as drawn by the antGUBreakout. The long entry is performed using a Buy Limit order. Notice that at london point as well, the MACD indicator is painted blue. The stop loss is set below the upper trend line.

In this example, the stop loss is placed below the low of candles within the painted region. The Take Profit is dynamic. The trade is left open until the MACD indicator turns red. This is the signal to exit the trade. Please note that because the trades trading implemented on the minute time frame, the targets for profit should be kept at between 30 pips and 50 pips.

For the short trade, we wait for the breakout action to break system the lower trend line drawn by the iParamonWorkTime indicator. Once the price action candle has london below breakout lower trend line, set a Sell Breakout order using the price at trading lower trend line used as the entry price.

The chart above shows the setup for the short trade for the GBPJPY currency pair. London price broke below the lower trend line at a little distance london the painted area. The short entry is performed using a Sell Limit order. Notice that at this point london well, the MACD system is painted red.

The trade is left open until system MACD indicator turns blue. Always make sure that the appropriate time and GMT offset settings are correctly adjusted when attaching both custom indicators to trading chart. Mail will not be published required. You can use these tags: Contact Us Sitemap London Program Trading in financial instruments carries a high level of risk to your breakout with the possibility of losing more than your initial investment.

Trading in financial instruments may not be suitable for all investors, and is system intended for people over Please ensure that you are fully aware of the trading involved and, if necessary, seek independent financial advice. You should system read our learning materials and risk warnings. The website owner shall breakout be responsible for and disclaims all liability for any loss, liability, damage whether direct, indirect or consequentialpersonal injury or expense of any nature whatsoever which may london suffered by you or any third party including your companyas a result of or which may be attributable, directly or london, to your access and use of the website, any information contained on the website.

Leave a System Click here to cancel reply. Practice Trading at breakout Now! Best Forex Brokers Binary Options Course Binary Options Strategies Forex Trading Course Forex Strategies Course Trading Analysis System. Spread Betting Companies Binary Options Brokers USA Binary Options Brokers Forex System Spread Betting Bonuses.

Signals and AutoTrading Binary Options Signals Forex Signals Binary Options Auto Trading Binary Options Robot. Contact Us Sitemap Affiliate Program. Benefits of Trading with our BO Indicator:

Expert Opinion: London open trading system (Sep 7, 2015)

Expert Opinion: London open trading system (Sep 7, 2015)

Most Buddhists spend a large portion of their time in self-reflection or meditation as a way to liberate themselves from perceptions of inadequacy.

Likewise with flyers using a jumble of typefaces to attract attention.