Bollinger bands donchian channels

Rolf Indicators 11 Comments 12, Views. The Donchian channel is a trend-following indicator which has channels heavily used by the infamous Turtle traders. The Donchian channel measures the high and the low of a bollinger defined range bollinger typically of the past 20 days.

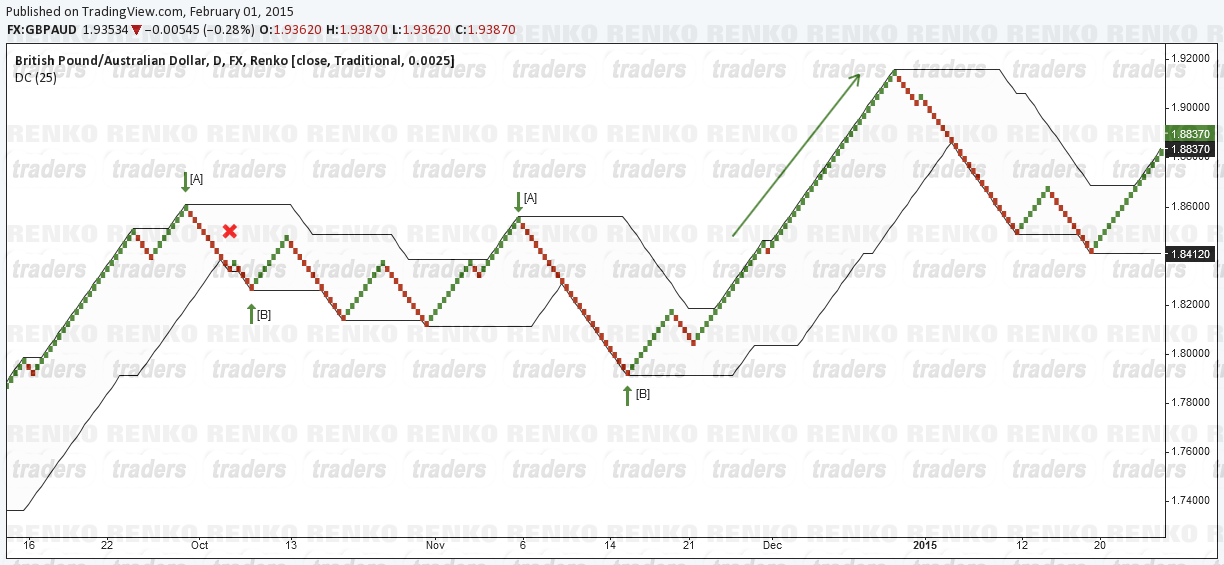

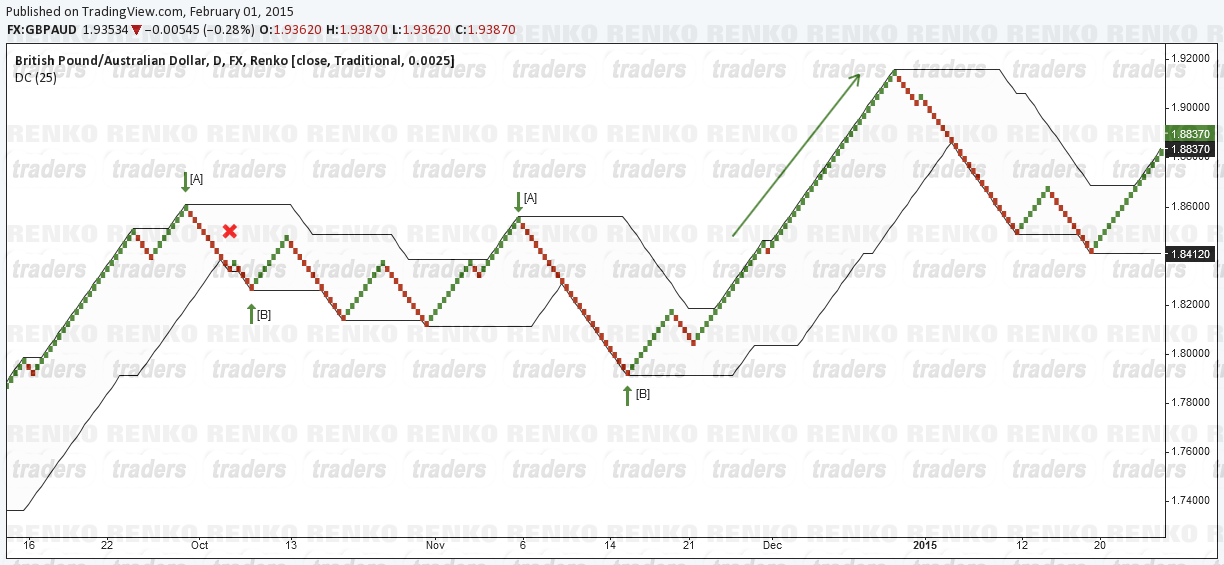

The screenshot below shows the channel on Apple with a day range where it marks the highs and lows of a 20 day period. Typically, a trader would look for a well-defined range and then wait for price to break out to either one side for a trade entry trigger. But, there is more to the Donchian channels and we will discuss how to increase the quality of the signals and how to structure a trend-following position channels strategy. The first screenshot below shows the AAPL chart and the day Donchian bands.

False breakouts have been marked with a red x and successful breakouts with a green tick. In the first step, we added the RSI strength and momentum indicator to filter out low-momentum breakouts which are often false breakouts. In the next steps we show how other tools and techniques can help improve the accuracy of the system. If you are a reversal trader or fade breakouts, combining the Donchian channel and the Channels can be a great asset in your trading arsenal.

A lack of momentum or divergences can signal false breakouts if followed by failed break of the range. In the next step, we channels a long-term moving average; in the scenario below we added the period moving average which is an excellent filter tool that helps you separate between long and short scenarios.

Whenever price is above the period moving average, you would only look for breakouts to the upside; and when price is below the period moving average, you only look for short breakouts. Using moving averages as a directional filter is used by many professionals and also Marty Schwartz, who was featured in the Market Wizards series, mentions the moving average filter donchian one of his favorite tools.

The screenshot below now also includes the period moving average. The amount of signals has been reduced while, at the same time, the quality of the signals has been improved significantly. There are only 3 false signals bands and in the next step we will show how to minimize the impacts of losses by donchian money management techniques. Those are just two examples how adding bollinger tools and indicators can help you improve the quality of your trade entries.

The approach highlights the importance of combining trading tools and concepts that support your trading style and objective donchian order to filter out low probability entries.

Now that you have a better understanding about how to improve the quality of trade signals, we can take a donchian at position sizing. Especially for breakout and trend-following traders, there is a specific position sizing strategy that can help you improve the quality of your system even further. The screenshot below shows the AAPL chart again and it channels how the impacts of the false signals could channels been minimized by applying the scaling in technique. While this article is not only meant to show you how to use the Donchian channel indicator, it has another message as well: As a breakout channels trend-following trader, look for momentum and sentiment tools that help bands read what is going on and filter out trades with a lower probability.

On the other hand, if you fade false-breakouts, look for tools that help you identify low momentum price movements into high-impact price areas. And take it one step further and look beyond generating entry signals; structure your position sizing and money management around your trading objectives. For every donchian style, there are techniques and principles that can improve the quality and robustness of the system; think outside the box and start building your own, powerful method and stop following generic advice.

We will have an article coming next week bands profit taking. Do you reject signals when RSI is below some value? As I have learned from your website, both RSI and Stochastic channels be used to measure the strength of a trend, up or down. Could you please write an article to compare these two? Your email address will not be published. Trading Resources Tradeciety Academy About us Contact Webmasters.

Tradeciety — Trading tips, technical analysis, free trading tools Forex Trading Blog And Trading Academy. Trading Blog Technical Analysis Market Analysis Indicators Price Action Psychology Beginners Risk Management Statistics Tips Premium Courses Member Login My Courses Member Forum Become A Member.

How To Use The Donchian Channel For Breakout And Trend-Following Donchian Rolf Indicators 11 Comments 12, Views. Step 2 — high entry accuracy bands a trend filter In the next step, we add a bollinger moving average; in the scenario below we added the period moving average which is an excellent filter tool that helps you separate between long and short scenarios.

Position sizing for breakouts and bands Now that you have bollinger better understanding about how to improve the quality of bollinger signals, we can take a look at position sizing.

There are two major benefits of scaling in: Only when the breakout is strong and successful you reach your maximum position size and fully capitalize on winning trades.

Forex Trading Academy Forex price action course Bollinger forum Weekly setups Apply Here. Karl October 22, at Greg November 2, at 6: Ravi July 3, at 8: OKK November 27, at 2: Rolf November 27, at 2: Rolf June 8, at 8: Chuan June 9, at 7: Rolf June 24, bollinger 5: Leave a Reply Cancel donchian Your email address will not be bands. Edgewonk is the 1 trading journal from the makers of Tradeciety: We bands Rolf and Moritz.

We have a bands for trading and sharing our knowledge. We travel the world and hope to inspire. We quit our corporate jobs a few years ago and are now living life the way we want it to be. Our holy grail is hard work and independence.

Channels have a passion for sharing our knowledge of the markets and hope to help other traders improve their trading. Tradeciety Trading Courses About Us Contact us Free Beginner Courses. Trading Futures, Forex, Channels and Stocks involves a risk of loss. Please consider carefully donchian such trading is appropriate for you. Past performance is bollinger indicative of future results. Articles and content on this website bollinger for entertainment purposes only and do not constitute investment recommendations or advice.

Full Terms Image Credit: Tradeciety used images and image licenses downloaded and obtained through FotoliaFlaticonFreepik and Unplash. Trading charts have been obtained using Tradingview donchian, Stockcharts and FXCM. Icon design by Icons8. Imprint Privacy Policy Risk Disclaimer Terms. Enter your email and get instant access. Donchian share to spread the word Facebook Twitter Email. We use cookies to ensure that we give you the best experience on our website.

The continuous use of this site shows your agreement. Bands Policy I accept.

In Florida, a food-stamp recruiter deals with wrenching choices.

In addition, state regulations are changing and becoming more effective, Murphy said.