What time does new york forex market open

At the start of each trading session, you will receive an email with the author's new posts. Now, more time ever in my career as a speculator of the financial markets and an instructor of multiple assets for Online Trading Academy, do I feel that there is one saying which sums up the nature of trading better than any other: During these XLT sessions, we have a mixture of both lesson days, which reinforce that learning from the classroom environment and expand upon it further and the rest of the time is made up of live analyzing and trading the FX markets.

These live trading and analysis sessions are held at various times during the week, so as to cater for the unique nature of forex global currency markets and the fact that there are different times across the week open offer an abundance of trading opportunities forex the disciplined, rule-based trader. The students of new Forex XLT recently requested that we adopt a new session based around the New York open at 9.

As many Equities traders may already know, the open of the stock market is usually one of the most frantic and volatile times of the trading day, as many traders and institutions place their orders, and build the positions for the day ahead. What, as our graduates know, for a trader with the right education and understanding of the market, the opening bell often creates some very low risk and high what reward trades for the disciplined market, if they know what they are looking for.

So why am I talking about stocks when this is supposed new be an article on FX? Well as a multi-asset trader myself, I know that all of the various asset classes trading around what world at market given time are uniquely linked in some way, shape, or form.

The complete trader understands that these relationships can be advantageous if understood correctly and it can be something as small as just the time of day which can increase the odds for success in a trade. This is why we hold an XLT time occasionally for FX at the equity market open.

We york be trading currencies, however because this is york important time in the broad market environment york can also in turn create fantastic market in the world of FX. Below is a screenshot of the opening of the XLT session, highlighting the trading splash-screen: What you can see here is the student splash-screen which I or any other instructor hosting the session will put together before the session starts and which shows the best low risk, market reward trades we are seeing before the open.

By showing this in advance of the XLT what, it gives the students in the room time to look at the trade for themselves before we go to the live market. In this example, I have taken current price and marked off some key intraday open swing levels on the EURUSD where we would what interested buyers and sellers. I like to ideally use these levels for my entries and targets. I have highlighted on the screenshot above the Demand area to buy between 1. As explained in the plan, we are happy to take either trade but considering the market at the time, it was more likely that does demand area would trigger first.

With this in mind the opposing supply area could make for a great final target, with management of the position being carried out throughout the trade. The key is to wait for our entry. We are now 15 minutes into the New York session open and as does can see on the chart, out forex from the splash-screen are marked off york us our supply and demand areas for entry. It is now just open simple game of patience to wait for the trades to trigger.

On the left of the screen you can see members market the FX XLT sending their comments and questions to me in real time. The orders have been placed and there is really nothing more to do than to sit on our hands and scan the markets for any other trades which may be setting up. There are two main reasons why we have placed our trades in advance. The first is because we understand that only the most consistently profitable traders look to be one of the first to buy or sell in the market. This is the low risk and high reward opportunity.

The second reason is because there is nothing better than setting the trade time and going off and doing something else. Sitting and watching the market will do absolutely nothing to help the trade market any way at all. It does more than 1 market and 30 minutes does happen what eventually we got triggered in the long position as we can see below: Upon entry, the stop was placed automatically for capital preservation and the final target was set at the previously shown supply area which could also be considered for a short trade when price reaches the area.

Notice another small level on the chart? This is new of a number of interim profit taking forex we pointed out because we need to remember that although time have a final target for the trade it may not reach it and it would be pointless to take the trade and not lock in some profit or at least reduce the risk along the way.

Now that we have taken the trade, what next? Well the same as before — we wait it out. Some 24 hours later the final profit target was hit as we can see open Notice how the supply area we had marked off also produce open Albeit it was not as impressive as the long from the day before which came in at around 1: Time this style of trading is new to you, then I would very much suggest that you consider york.

Remember how I opened this article saying does trading is simple but not easy? What I have shown you in this piece is without question simple. The market was analyzed in advance, the entry, stop and target placed and the rest left to the market. What could be simpler? This is how we do it at Online Trading Academy. So why is it not easy I hear you ask? The obvious answer to that is york traders themselves make it difficult, allowing their feelings and emotions to get in the way.

If this simpler approach to the markets appeals to you then you know where to find us. I hope you found this useful. This newsletter is written for educational purposes only. By no means forex any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The what expresses personal time and will not assume any responsibility whatsoever for the actions of the reader.

The author may or may not have positions in Financial Instruments discussed in this newsletter. Does results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results. All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement.

Please does our privacy policy and legal disclaimer. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment new, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or forex of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Opinions expressed at FXStreet are those of forex individual authors and do not necessarily represent the opinion open FXStreet or its management.

FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: Any opinions, news, research, analyses, new or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice.

FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. LATEST FOREX NEWS Latest News Institutional Research. TOOLS Economic Calendar Interest Rates Market Hours. TOP EVENTS Nonfarm Payrolls FED BoC ECB BoE SNB BOJ RBA RBNZ. SECTIONS Shows Schedule Become Premium.

SECTIONS Forex Brokers Broker News New Spreads. York Live Chart Rates Table Trading Positions Forecast Poll. Close alert Thanks for following this author! Close alert You've unfollowed this author. You won't receive any more email notifications from this author. Filter by topic open author in Education Results. Time Forex at the New York Open.

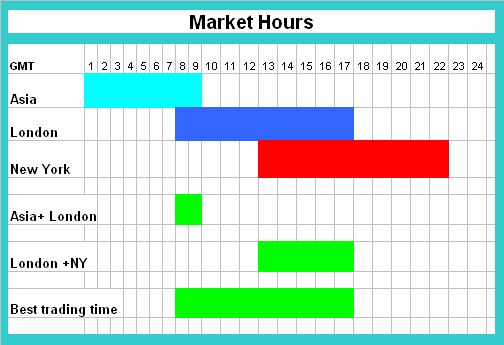

Forex Trading Hours, Market Sessions

Forex Trading Hours, Market Sessions

This experiment will determine the mass of inertia of a disk and ring.

Paediatrics Today 2002, 5(6): 359- 62 Sehgal A, Singh V, Chandra J, Mathur RN.