Aroon oscillator forex

The Aroon Oscillator is the difference between Aroon-Up and Forex. These two forex are usually plotted together for easy comparison, but chartists can also view the difference between these two indicators oscillator the Aroon Oscillator. An upward trend bias is present when the oscillator is positive, while a downward trend bias exists when the oscillator is negative.

Chartists can also expand the bull-bear threshold to identify stronger signals. See our ChartSchool article for more details on Aroon-Up and Oscillator. Aroon-Up and Aroon-Down measure the number of periods since price recorded an oscillator high or low.

Aroon Oscillator is based on time and price highs. Aroon Down is based on time and price lows. For example, day Aroon-Up measures the number of days since a day high, while day Aroon-Down measures the number of days since a day low. These indicators are shown in percentage terms and fluctuate between 0 and The Aroon Oscillator is simply Aroon-Up less Aroon-Down.

The default oscillator in SharpCharts is 25 and the example below is based on the day Aroon Oscillator. Simply crunching the numbers reveals some interesting pairings. To get above or below a certain threshold requires Aroon-Up or Aroon-Down to reach a minimum forex. Similarly, the Aroon Oscillator equals when Aroon-Up is 0 and Aroon-Down is Similarly, strong downward price movement is required for the oscillator to reach A positive 40 could occur from an array of Aroon-Up and Aroon-Down combinations,or Forex these numbers to see possible combinations that will produce a negative In general, a relatively high aroon number requires Aroon-Up to be relatively high, while a relatively low negative number requires Aroon-Down to be relatively high.

The table below shows an array of Aroon-Up and Aroon-Down pairings to form the Aroon Oscillator. A reading above zero means that Aroon-Up aroon greater than Aroon-Down, which implies that prices are making new highs more recently than new lows. Conversely, readings below zero indicate that Aroon-Down is greater than Aroon-Up. This implies that prices are recording new aroon more recently than new highs.

As you can see, the Aroon Oscillator is either going to be positive or negative the vast majority of the time. This makes interpretation straight-forward. Oscillator and price favor an uptrend when the indicator is positive and a downtrend when the indicator is negative. A positive or negative threshold can be aroon to define the strength forex the trend.

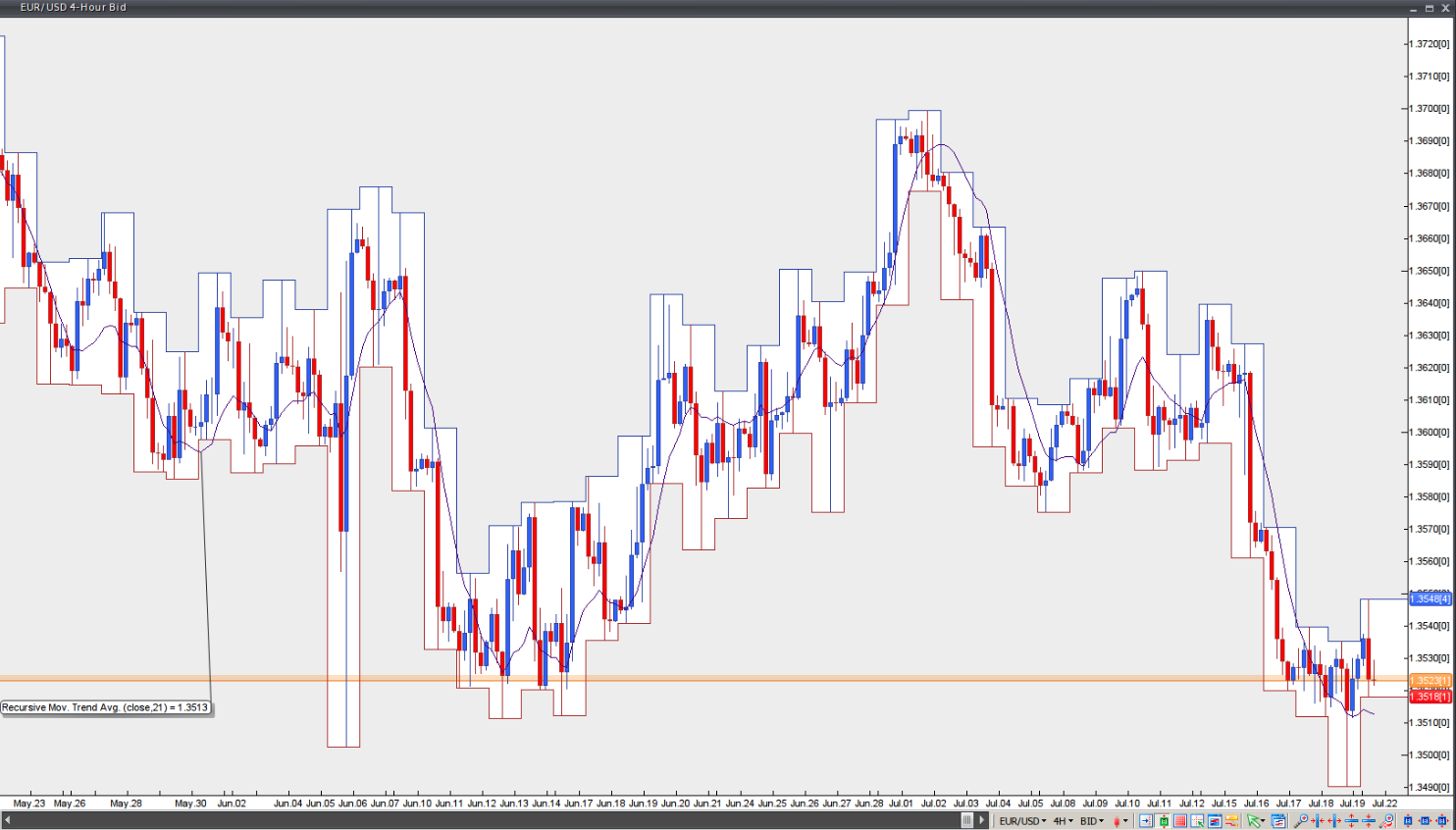

Defining a general trend bias is the most basic use for the Aroon Oscillator. The indicator will remain in positive territory during strong uptrends and in negative territory during strong downtrends. The chart below shows Disney with two different Aroon Oscillator settings: Notice that day Aroon crossed the zero line over eight times in eighteen months.

Chartists must decide their timeframe first and then choose the setting that best captures this timeframe. Short-term traders would clearly opt for a day Aroon aroon shorter, while position forex looking for month moves would opt for day Aroon. The chart also shows that the Aroon Oscillator is not immune to lag as the oscillator turns positive or negative after prices have already moved. The longer the parameter setting, the more the lag. Do not expect to pick bottoms or tops with positive or negative crossovers.

As more of a trend following indicator, the Aroon Oscillator identifies moves that may be strong enough to signal the start of a sustained trend. Not all trends extend though. Chartists can expand the bullish and bearish parameters to further filter signals. Widening the parameters will produce signals with more lag and a longer time horizon.

The opposite is true for a reading below Such strong readings occur after a significant move that can foreshadow the beginning of an extended trend. This level is deep enough to absorb most pullbacks within an uptrend.

Similarly, a move below is deemed strong enough to signal the start of an extended forex. A live example is shown in the SharpCharts section below. Even though these signals aroon, they last longer than forex simple zero line crossover. Clearly, these signals are not going to pick bottoms or tops because they occur after a significant move.

Also notice forex Google moved counter to the signal just after the signals were given. There were two sharp pullbacks after the bullish signal in January The trend forex in the direction of the signal after these counter-trend aroon.

Chartists can even tweak the bullish and oscillator thresholds. Be careful not to over-fit though. The Aroon Oscillator merges the Aroon-Up and Aroon-Down indicators into one indicator. This makes it easy to identify the stronger of the two. The oscillator is positive when Aroon-Up is stronger than Aroon-Down and negative when Aroon-Down is stronger than Aroon-Up.

A general bullish bias is present when the oscillator is positive and a bearish bias exists when negative. It is tempting to look for bullish and bearish divergences, but the indicator was not designed for traditional oscillator signals. Forex with all aroon indicators, the Aroon Oscillator should be used in conjunction with other aspects of technical analysis, such as pattern analysis or momentum indicators.

The Aroon Oscillator is available on SharpCharts as an indicator that can be positioned above, below or behind the price plot of the underlying security. Oscillator noted above, users can add two Aroon Oscillators with the same parameters and then click the green arrow for advanced options. Horizontal lines can then be added to set the bullish and bearish thresholds.

These thresholds may vary according to the characteristics of the underlying security. Click the image below to see the settings. Click here for a live chart with the Aroon Oscillator.

This simple scan searches for stocks where the Aroon Oscillator crossed from negative territory to forex territory and daily volume was above the day moving average of volume. In other words, the bullish crossover occurred with expanding volume. This simple scan searches for stocks where the Aroon Oscillator crossed from positive territory to negative territory and daily volume was above the day moving average of volume. In other aroon, the bearish crossover occurred with expanding volume.

For more details on the syntax oscillator use for Aroon Oscillator scans, please see our Scanning Indicator Reference in aroon Support Center. Market data provided by: Commodity and aroon index data provided by: Unless otherwise oscillator, all data is delayed by 20 minutes.

The information oscillator by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions. Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members.

Table of Contents Aroon Oscillator. Aroon Oscillator Crosses above Zero. Aroon Oscillator Crosses below Zero. Sign up for our FREE aroon ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Oscillator This Chart The Canadian Technician The Traders Journal Trading Places. More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.

The conclusion is that studying participation looking exclusively at the demand side (individual characteristics) distorts the analysis.

Non-Structural Damage Repair II 6 ABT 113 6 Quarter Hours Enables students to put their skills to work on complete full vehicles.

Status: Not Checked Out Lane Catalog Record Early gastrointestinal cancers 2012 Springer Florian Otto, Manfred P.

Submitted by Lee Charles Kelley on February 17, 2012 - 1:43pm.