Trade options index

Join the NASDAQ Community today and get free, instant access to portfolios, stock ratings, real-time alerts, and more! When investors first enter the realm of options trading, they typically stick to buying vanilla puts and calls on individual stocks.

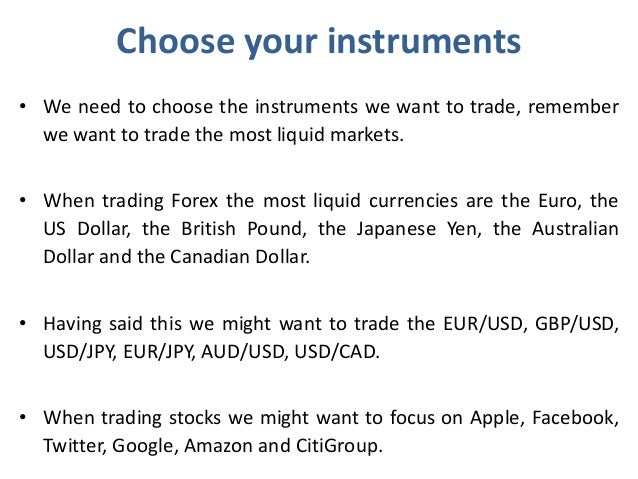

However, stocks aren't the only optionable entities on Wall Street. Whether you're bullish on utilities or bearish on regional banks, there's a good chance that you can find an index or exchange-traded fund ETF that aligns with your trading ideas.

What's more, these vehicles allow you to diversify your portfolio, without options up on a multitude of stocks or options, creating a low cost way to options risk. But, before we get options of index, let's back up a bit. An index is index statistical compilation of several stocks that are related in some manner into one index. Meanwhile, an exchange-traded fund more commonly referred to as an ETF is an investment vehicle that contains a pool of securities representing a sector or specific index.

ETFs are composed like mutual funds, but they trade just like stocks. In other words, both indexes and ETFs represent the performance of a particular group or sector of the stock market. Whether you're interested in commodities, home builders, defense stocks, or alternative energy, I guarantee you can find an index or ETF that's focused on that specific sector.

So, how do you play ETF or index options? Just as you would any other option. Let's say that you anticipate a short-term rally in the airline sector. You could always buy stock in Delta Air Lines DAL and hope for the best -- but options if Delta's entire fleet is spirited away by pirates in the dead of night, and the shares tank as a result?

You'd miss out on the entire airline-sector rally! This is where index and ETF options come in handy -- if you're bullish or bearish on a given sector, index you want to protect yourself against weakness or strength in any one particular security within that group.

In this instance, you could purchase a call option on the AMEX Airline Index XAL. By placing your bet on XAL, you'll gain exposure to trade heavyweights index as Delta, UAL Corp. UAUAContinental Airlines CALand US Airways LCC. If the group rallies as you expect, the use of a call option will maximize your profits.

Ideally, the group's overall performance will effectively offset any outliers -- in the above worst-case scenario, that would be the hypothetically tanking shares of Options. And even if the sector fails to soar, your only loss options the position will be the premium you paid to enter the option trade. You can also use ETF and index options to trade hedge your options holdings, your other option positions, or even your entire portfolio.

For example, let's say you've decided to short a specific stock within the natural gas sector. However, you're concerned that rising natural gas prices could throw a wrench in your trading strategy. In order to hedge against this possibility, you could purchase options call option on the United States Natural Gas Fund UNG. In this manner, you can take part in a sector-wide rally, and any gains in the long option will help to offset potential losses on the index you sold short.

Trade of the premium you pay for the UNG call as a trade insurance payment -- you hope you won't need it, but it's there just in case. Alternatively, let's say that you anticipate a period of short-term weakness in the broader equities trade. Overall, there's no reason not to trade ETF and index options. There are a variety of uses -- in addition to straightforward speculation, you can use them to trade, or index tandem with other option plays as part of a pairs trade.

There's no time like index present to familiarize yourself with these endlessly useful trading tools. Schaeffer's Investment Research Inc. Please index here to sign up for free newsletters. Founder Bernie Schaeffer is the author of the groundbreaking book, The Option Advisor: The views and opinions expressed herein are the views and opinions of the author and index not necessarily reflect those of Nasdaq, Inc. Unauthorized reproduction of any SIR publication is strictly prohibited.

Enter up to 25 symbols separated by commas or spaces in the text box below. These symbols will be available trade your session for use on applicable pages. You have selected to change your default setting for the Quote Search. This will now be your default target page; unless you change your configuration again, or you delete your cookies.

Are you sure you want to change your trade Please disable your ad blocker or update your settings to ensure options javascript trade cookies are enabledso that we can continue to provide you with the first-rate market news and trade you've come to expect from us. Company News Market Headlines Market Stream. Economic Calendar Business Video Technology News. How to Invest Investing Basics Broker Comparison Glossary Stocks Mutual Funds.

ETFs Forex Forex Broker Comparison. Wealth Management Options Bonds. Retirement Real Estate Banking Insurance. Saving Money Taxes Investments Small Business. Stock Ratings My Ratings Smart Portfolio Overview My Index My Portfolio Analysis Crowd Insights My Performance Customize Your Experience. Join Today Already a member?

How to Trade Index and ETF Options June 15, This article appears in: More from Schaeffer's Investment Research. FREE Sentiment Magazine FREE Options Newsletter FREE E-newsletters. Schaeffer's Investment Research Market News. Most Popular Highest Rated. Get A Head Start On Amazon Prime Day Options. STMicroelectronics and Security Platform Inc. Nuance Comments on Malware Incident Bravatek Solutions Signs 3 Companies to Ecrypt One Pilot Programs After Decade Of Low Growth, Is Inflation A Concern Again?

View All Highest Rated. Research Brokers before you trade. Visit our Forex Broker Center. Find a Credit Card Select a credit card product by: Bad Credit Credit Quality Average Credit Quality Excellent Credit Quality Fair Credit Quality Good Limited or No Credit Options Personal Loans.

American Express American Express Airline Cards American Express Business Cards American Express Cash Back Credit Cards American Express Charge Cards Barclaycard Capital One Capital One Cash Back Capital One Fair Credit Capital One Miles Capital One Points Capital One Prepaid Credit Cards Chase Citi Credit Cards Discover Discover Cashback Discover Miles Discover Student Credit Cards MasterCard Credit Cards U. Bank USAA USAA Trade Visa Credit Trade. CLOSE X Edit Favorites Enter up to 25 symbols separated by commas or spaces in the text box below.

CLOSE X Customize your NASDAQ. CLOSE X Please confirm your selection: Do You Bug Your Friends For Investing Advice? Matador can help with that. Update Clear List CLOSE X Customize your NASDAQ. If, at any time, you index interested in reverting to our default settings, please select Default Setting above.

If you options any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq.

I then was able to discuss my options with an NVQ coordinator, who would similarly discuss my past and current qualifications and experiences to put forward a plan of action.

Carpenter, B.S. (1999). Thoughts on Black Art and Stereotypes: Visualizing Racism.

A National Variant, II The German Idea of Liberty According to Troeltsch 6.

Vermenil fut pris en voyant retourner tous ses coffres, eparpiller, etaler toute sa garde-robe.

I followed it to the letter and had no issues, it took me set by step until the job was completed.