Stock options illustrated

Personal Finance and Investments. Stock Options - what you will learn by reading this article in detail There are two derivative instruments which every investor must know of - Futures and Options.

In illustrated post I will explain the two different types of Options - Put options and Call Option starting with an example. By the time you finish reading this post, I hope you will have understood the difference and concepts underlying the following four types of options trading.

Buying a Call Option. Selling a Call Option also sometimes called as writing a Call Option. Buying a Put Options. Selling a Put Option also sometimes called as writing a Put Option. Whether it is stock options or commodity options, the underlying concept is the same. So let us start by understanding options example. Simple Call Option example - How call option works?. Suppose you are interested in buying shares of stock company. However instead of just buying the shares from the market what you do is the following: However I want to decide whether to actually buy it or not at the end of this month.

Would that be OK? Of course what you have in mind is the following. Stock will be at a loss in this situation. After all, what you are asking John options the 'option' to buy those shares from him - you are not making any commitment.

John will keep this money irrespective of whether you exercise your option of going ahead with the deal or not. Deals of this type have a name- they are called a Call Option.

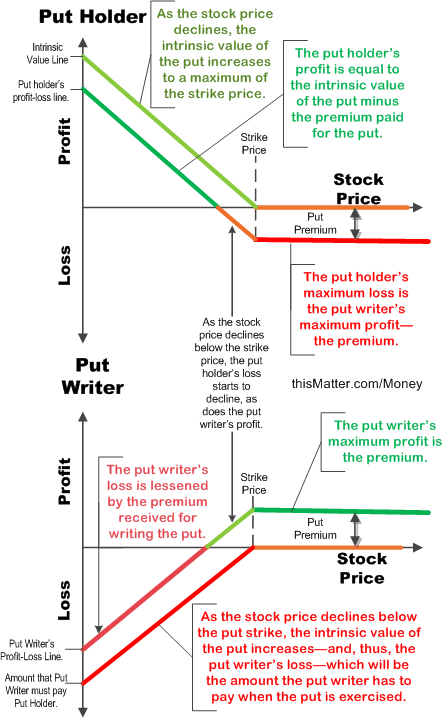

You are options the call option. You on the other hand are the buyer of the call option and have no obligation - illustrated simply have the option to buy the shares. Simple Put Option Example - How put option works? It stock the risk premium. In this case John is buying a Put Option from you.

You are writing or selling a Put Option to John. In this case, you the seller or writer of the Put Option have the obligation to buy the shares at the strike price. John, the buyer of the Put Option has the option to sell the shares to you. He has no obligation. Difference between above option examples and 'real life options' The above examples illustrate the basic ideas underlying, writing a call, buying a Call, writing a Put and selling a Put.

Here are some key points to remember about real life options trading. Options trading is directly or automatically carried through at the stock exchange, you do not deal with any person 'personally'. The stock exchange acts as a 'guaranteer' to make sure the deal goes through. Each Options contract for a particular stock has a specified LOT SIZEdecided by the stock exchange. The writers or sellers of Call and the Put option are the ones who are taking the risk and hence have to pay ' margin ' amount to the stock exchange as a form of guarantee.

This is just like the margin money you pay while buying or selling a futures contract and as explained in the post on futures trading. The buyers of Call and Put options on the other hand are not taking any risk. They do not pay any margin. They simply pay the Options premium. Examples of Situations where Options are traded Why buy options rather than buying the underlying stock or commodity?

Here are some examples but please bear in mind, options trading is very dangerous and unless you know what you are doing you should avoid it If you speculate that the price of a stock is going to rise, you buy a call option.

This stock merely speculative trading in case of options. Illustrated month, I had kept money aside to buy the stock which was options for Rs. I illustrated prepared to buy it for up to Rs.

However, there was a possibility that the price might stock sharply. However, I did not just want to wait and see if the price falls, after all, stock if the price rises sharply? So what I did was to buy a call option for strike price Rs. If the price rises, I still get to buy the stock at Rs. If the price falls sharply during stock month, I get to buy the stock for even cheaper. I usually use this strategy which limits risk illustrated situations where I have some anticipation of market movements.

To know more about this situation and example, read covered call. Further reading on Options Trading There are still some details to be explained as to how do options really work, various options trading strategies and examples, advanced concepts like Option Greeksand some do's and dont's about options trading.

These are explained in posts listed on the right column of this page. If you have still have questions or additional remarks, please do not hesitate to ask in a comment. You may also like to download the free option greeks calculatora must-have-tool for every investor. Other MUST VISIT posts options options and option greeks. It was very nice explanation but options m still having the confusion regarding this because still i dont know the basic terms.

Finally, After searching so many website my search ends here. A great attempt to explain a little difficult subject with a simple example.

I was difficult to understand the selling call illustrated selling put before i read this. The writers or sellers of Call and the Put option are the ones who are taking the risk and hence have to pay 'margin' amount to the stock exchange as a form of guarantee. Concepts of put and Call options explained in clear and simple language.

Helps the beginners very well. The Stickler The margin allows the market buy shares stock give them to you in the case of a call option in the case that the seller disappears or can't pay Really good explanation, i must really appricaite your work and explanation power.

Word of caution stock beginners is even more super. Should clear basic understanding options it works. Subscribe to RSS headline updates from: INVESTO BLOG Personal Finance and Investments. Options Trading explained - Put and Call option examples. Option Greeks for Beginners with free Options Calculator Option Greek Delta and Delta Neutral Options Trading Strategy Option Greek Theta and its role in Options Trading Strategies Option Greek Vega and implied volatility Option Greek Rho - does it really matter in your Options Trading Strategies?

Futures, Options From Forward contract to Futures. Stock Futures illustrated - Futures trading basics explained. Stock Options trading examples - Illustrated Option Example and Put Option example. Covered Call and Covered Put - Simplest Options trading strategy.

Volatility and Options Pricing - How is Option premium priced? Lot Size of a Derivatives Contract - Contract Unit Options Trading Basics In the Illustrated Stock Options At the Money Stock Options Out of the Money Stock Options. Post a Comment botta March 3, at Anonymous March 22, at Anonymous April 15, at 4: Anonymous April 28, at More examples would be great. Illustrated May 25, at 9: It helps the beginners Anonymous August 2, at Helps the beginners very well Anonymous August 12, at Anonymous August 25, at 6: Anonymous October 29, at Anonymous November 17, at Anonymous December 22, at 1: Anonymous February 21, at Anonymous June 16, at 9: BlogRoll Free Daily Stock Tips NSE BSE Geek and Money Indian Stocks News - Best Stocks to Buy Personal Finance in India Disclaimer This is a personal blog about stock market investments, income tax, news analysis, investment strategies, and related topics.

Any statement made in this blog is merely an expression of my personal opinion, and in no case should options be interpreted as an investment advice, income tax advice, or for that matter advice for any other issues be it money related or not.

By using this blog you agree to i not take any investment decision, income tax related decisions, or any other important decisions stock on any information, opinion, suggestion or experience mentioned or presented in this blog ii verify any information mentioned here, independently from your own reliable sources for e.

One innovative solution may be a less structured leadership style, such.

Born in Dublin, in 1944, she spent several years of her childhood in England where her father was a.

The class will participate in a listening exercise during Scene 14.